How Is The Drop In House Prices Impacting Property Investment?

Turbulence has hit the UK property market. Rising energy costs, a reduction in spending and rising interest rates are all affecting the rate and price of home sales. For those who make an income from property investment, the threat of home prices dropping could pose a real problem, leaving many property portfolio owners wondering if they should still invest in buy-to-let homes.

Are House Prices Going Down?

Current data indicates that house prices have stalled and are even falling in some areas. A larger number of property exchanges are also failing to reach completion and buyers need significantly higher deposits to get onto the housing ladder.

With the threat of recession looming, buyer confidence has also been shaken for those looking to buy a property for the first time and finance is increasingly tricky to obtain.

Things Are More Positive Than They Seem.

It is not all doom and gloom – current figures show that average home prices are still up more than 7% when compared to prices from 12 months ago.

Will house prices go down in 2023?

So, what does all this mean for 2023 and beyond? While home prices do seem to be softening and sales are slower, the overall availability of mortgage products has increased slightly. This increase in product availability may bode well for buyers who still have the resources to move.

Some economic analysts have predicted an overall drop in the housing market of 5% -10%. This is influenced heavily by where homes are located in the UK. Parts of the South and central London are expected to better maintain pricing levels due to international investment and an affluent population.

Region by region the impact of the current economic climate may affect home sales to a greater or lesser degree, with some areas experiencing minimal movement.

Are Some UK Houses Overvalued?

With the heavy fluctuation of pricing across the nation and regional variances, there have been questions about the price levels of some properties. Property sales gained huge momentum after being stalled for two years during the Covid pandemic, leading to percentage increases that hit double digits in some parts of the UK while other areas like East Yorkshire lagged behind at 5%. A situation that has began to level off in recent months.

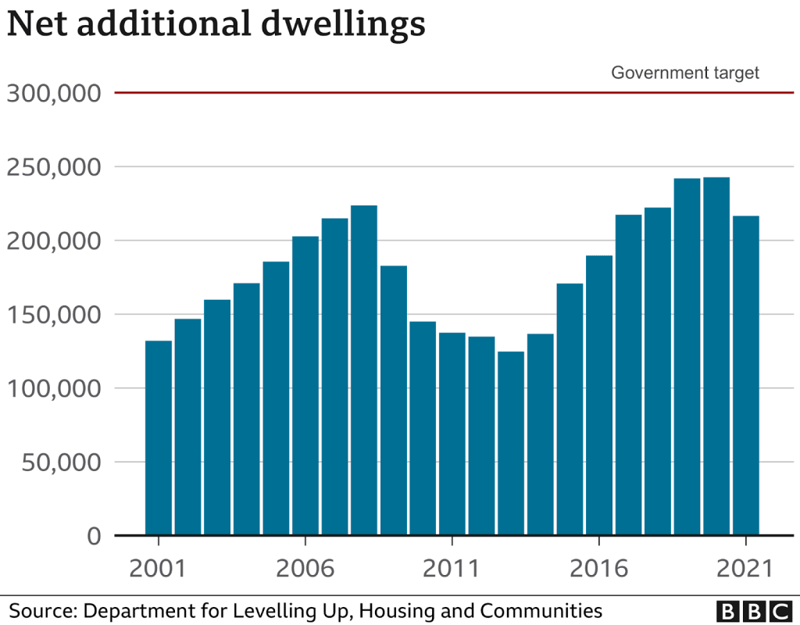

Even with some levelling of sales prices, there is still much consumer scepticism. For property investors seeking long-term gains, this could simply be a blip on the radar as rising equity offsets lowered prices across the long term. Systemic house building shortfalls, with a rapidly growing population, mean that there is still a low supply of houses. By 2019, England’s total housing need backlog has reached four million homes and the government’s new build targets have been missed every year since then:

The National Housing Federation suggests that England needs 340,000 new homes (including 145,000 affordable homes) until 2031.

Meanwhile, everybody needs a roof over their head. Therefore, if the general populus cannot afford to buy, demand for rentals is likely to increase exponentially.

Should I Still Invest In Buy-To-Let?

Buy-To-Let properties that can be bought off plan still present a strong investment opportunity. The price of properties may be substantially lower than in the last couple of years (due to current buyers being less committed to purchasing homes) which can be good news for investors who wish make excellent monthly income until prices rise again. The rental market is still booming, with the average monthly rent increasing by £115 according to Hometrack’s Q3 Rental Market Report.

Less cost of acquisition for property investors, while fewer people are moving or able to own their own homes can mean that demand will remain strong for rental property.

A higher inventory will provide investors with a chance to buy low and rent high, achieving maximum income for minimum outlay. In the case of buying an off-plan property, investors will still have the ability to buy pre-construction homes at favourable prices and make positive equity gains and profits over the long term.

Before committing to any property investment purchase in this uncertain market it can be wise to seek advice on the best way to maximise your investment. Contact Redmayne Smith today and receive expert help and guidance for all your property investments.

Leave A Reply

Your email address will not be published, Required fields are marked *