How Changes In UK Interest Rates Impact The Buy to Let Market

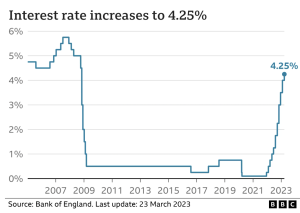

Following the 11th consecutive UK interest rates rise on Thursday 23 March 2023, a lot of investors are wondering what the ramifications for the buy to let market will be. Mortgage rates are dictated by interest rates, which in turn significantly impact the buy-to-rent market. As an investor, you want to be sure of affordability of finance, rental yields, and the potential for capital gains.

But will the latest 0.25% rise drastically change the investment landscape for property investors?

How Do Increased Mortgage Rates Affect The UK Buy to Let Market?

The three key considerations for looking at the impact of mortgage rates on the buy to let investments are:

- Investors’ ablility to purchase new investments.

- Rent increases to maintain NET yields.

- Higher demands for rental properties as buyers are deterred by mortgage rates.

Rising mortgage costs from the previous 10 increases are already affecting an estimated 100,000 remortgaging homeowners and first-time buyers each month. Consequently, demand for rental properties is skyrocketing. For context, rental demand is 46% above the five-year average, whilst the number of homes for rent is 38% below the five-year average.

How Do UK Interest Rates Impact Investors?

Whilst changes in mortgage rates can create a number of challenges for property investors, it is important to note the most recent change is likely to have a minimal impact. Fixed-rate mortgages have fallen for 4 months in a row. Despite the base rate rise to 4.25%, mortgage rates are likely to remain between 4% and 4.75% for much of 2023. Additional pressure on the Bank of England to reduce interest rates as soon as inflation is under control means that this is likely to be close to the peak. A growing phenomenon of cheaper 5-year fixed-rate mortgages than 2-year fixed-rate mortgages is due to banks factoring in these probable interest rate cuts.

After a long spell of exceptionally low interest, the cost of mortgage finance is still higher than it was at the start of 2022, which will need to be factored into financial planning for buy to let investors. The positive news is increased demand in today’s thriving rental market mitigates the issue with the ability to charge higher rents.

How Can I Ensure Buy To Let Success?

Successful investors focus on effective portfolio strategy. Working with the experts at Redmayne Smith will help you conduct thorough due diligence to select the right investment properties. A well-planned buy-to-rent portfolio is crucial for navigating the impact of changes in mortgage rates on the rental property market.

Redmayne Smith select how and where to invest to maintain positive rental yields and make your new or expanding property portfolio profitable.

Redmayne Smith removes the stress from property investment. If you want an end-to-end service with thorough research into the most profitable areas, market value research, rental yields and trustworthy developments only, join our next property investment seminar to find out more.

Leave A Reply

Your email address will not be published, Required fields are marked *